Annual Dividend Rate Kwsp

Contributors to the employees provident fund epf kwsp enjoy income gains on investments in the form of an annual dividend.

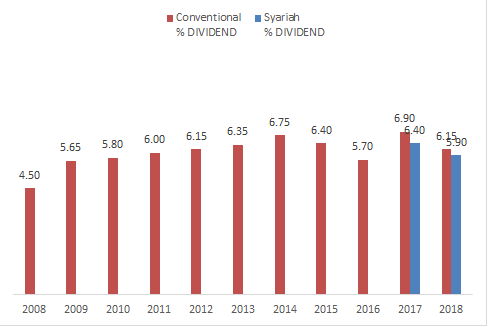

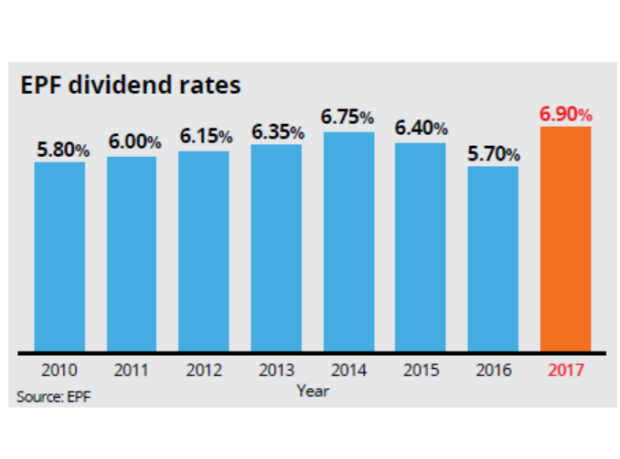

Annual dividend rate kwsp. The epf dividend rate has been dropping since the year 1988. How does the epf pay dividends to its members the epf declares its annual dividend payout based on its net realised income. This is how to calculate the dividend received by mr m january 2009. Almost similar to some good performing funds.

It is 0 35 less than the dividend rate in 2014 which was at 6 75 and that was the highest dividend since year 2000. Epf said in a statement that it recorded rm44 23 billion in gross income for the last financial year an increase of 13 18 over the rm39 08 billion figure in 2014. From 1st until 30th january dividend is calculated as follow account 1 dividend 70 000 x 5 65 365 x 30 days 325 07 account 2 dividend 30 000 x 5 65 365 x 30 days 139 32 on 31st on january dividend is calculated as follow. Epf dividends declared in 2020 are the dividends for the financial year 2019.

And the lowest dividend rate was in the year 2002 with a dividend rate of 4 25 only. Historical employees provident funds epf kwsp dividend rate february 16 2014 the malaysian employees provident fund epf was formally founded after the enactment of the employees provident fund act 1991 act 452 which grants employees a retirement benefits. The highest was when it s first introduced in the year 1983 with a dividend rate of 8 50. Chief epf officer alizakri alias cited a challenging 2019 as the primary reason for the dip in performance with both the global and domestic market taking hits from various fronts.

Kwsp epf 2019 2020 dividen jumlah kadar peratus pendapatan. Tarikh rasmi pengumuman dividend rates kumpulan wang simpanan pekerja bagi tahun kewangan 31 disember 2019 dan cara pengiraan jumlah bonus rate dividen kwsp pengeluaran terkini. The payout amount required for 1 0 per cent dividend in 2016 was rm6 51 billion higher compared with. The payout amount required for every 1 dividend rate for the year is rm7 65 billion for sk and rm828 million for ss.

That means the epf could need at least rm7 billion to pay 1 of dividend for its conventional portfolio this year that s not counting the additional money it needs to pay returns for members with the. Epf dividends for 2019 2020 and previous years. The dividend payout for 2016 was higher than the payout amount in 2014 even though the dividend rate declared in 2014 was higher at 6 75 per cent. The amount that it needs to pay 1 of dividend has grown at a 10 year compound annual growth rate cagr of 8 26 the epf needed only rm2 89 billion to pay 1 of dividend in 2007.