Blr Rate Malaysia 2019

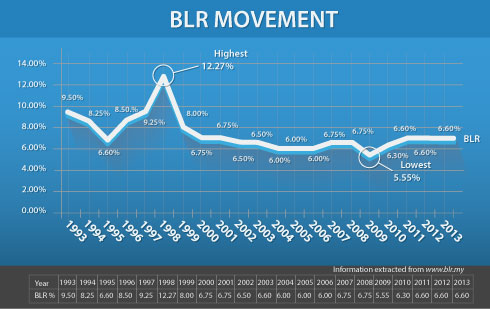

Base rate br is in accordance to the new reference rate framework introduced by bank negara malaysia and it replaces the base lending rate blr as the pricing for retail loans effective 2nd january 2015.

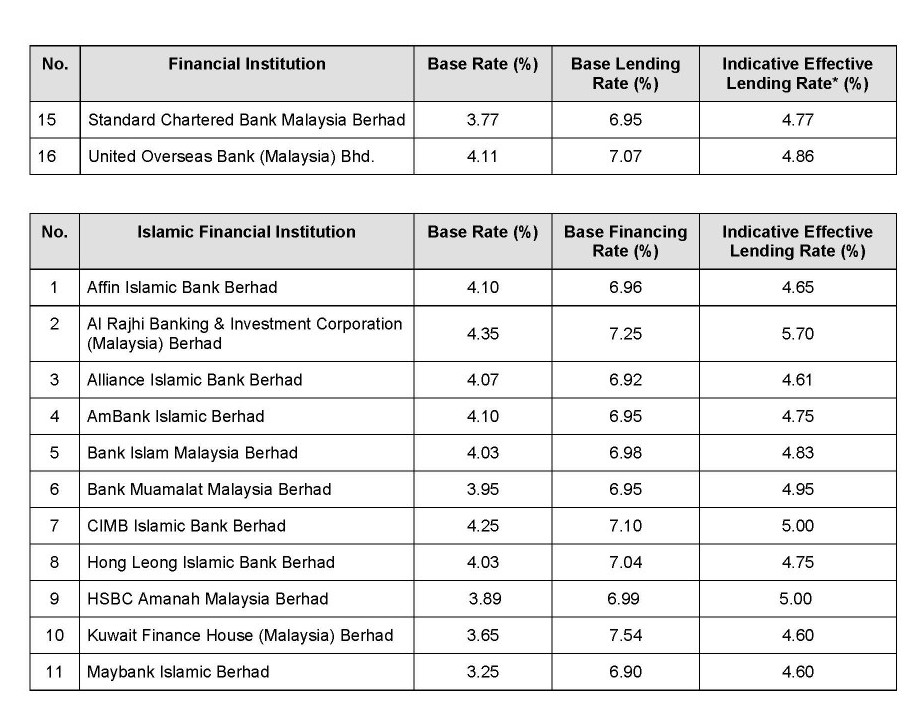

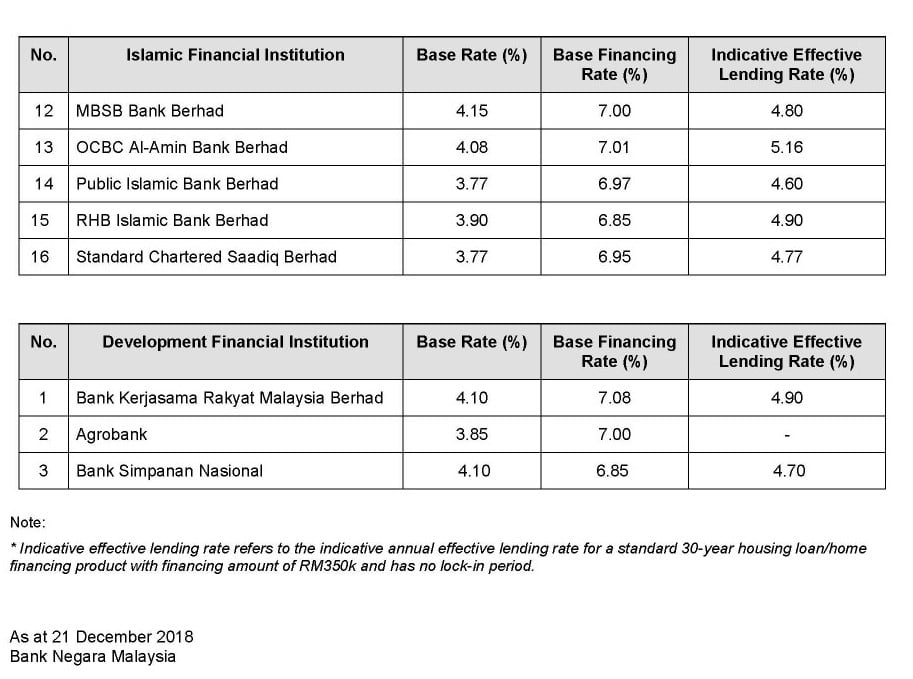

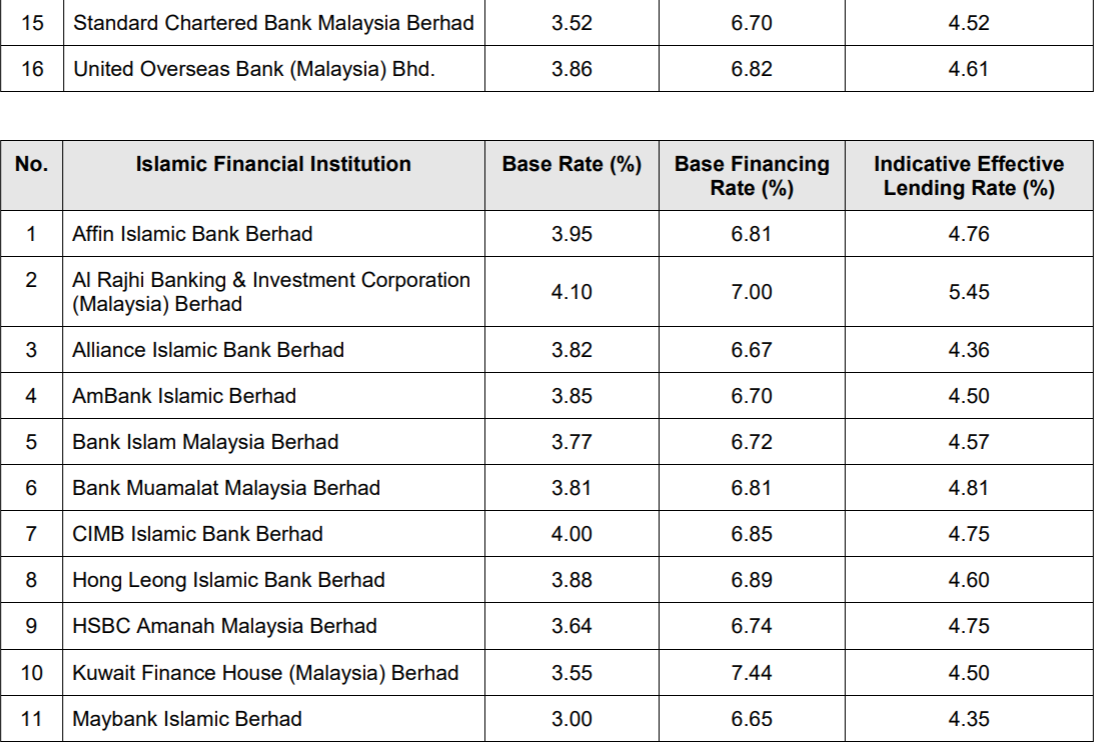

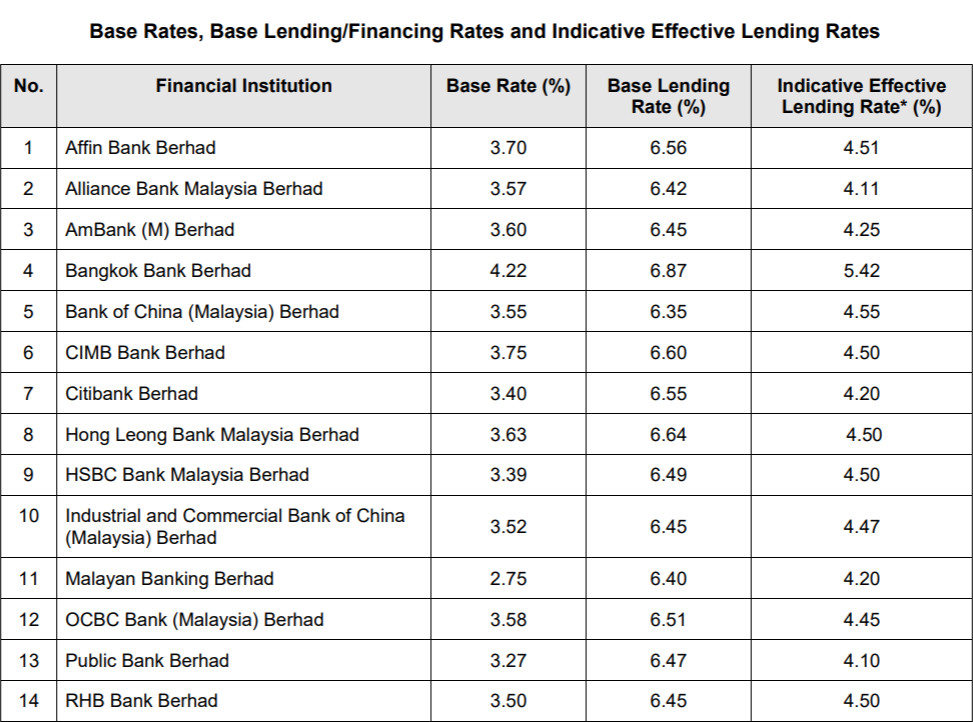

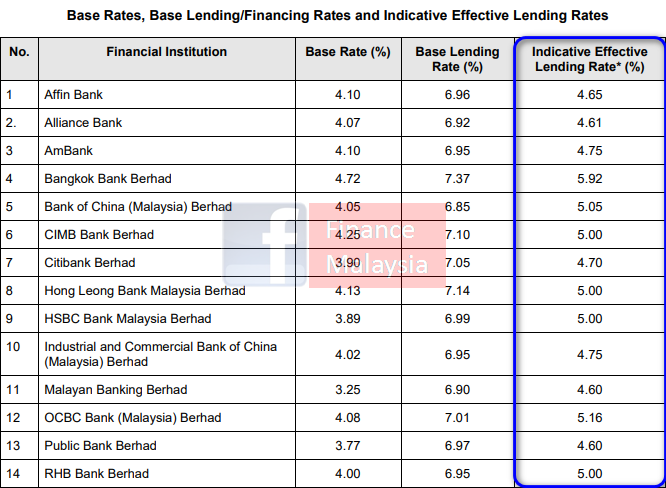

Blr rate malaysia 2019. Under br which now serves as the main reference rate for new retail floating rate loans banks in malaysia can determine their interest rate based on a formula set by the central bank. While we makes every effort to provide accurate and complete information we strongly recommend that viewers to acquired latest base rate blr bfr information directly from its official website respectively. Latest blr base rate fixed deposit interest rates from every bank in malaysia. This brings about a drop of its base rate from 4 to 3 8 and its base lending rate from 6 95 to 6 75 for rhb bank rhb islamic bank and rhb investment bank.

Hlb and hlisb announce decrease in br ibr and blr ifr kuala lumpur 15 may 2019 in line with the recent reduction in bank negara malaysia s overnight policy rate opr hong leong bank berhad hlb and hong leong islamic bank berhad hlisb would like to announce reductions in its base rate br and islamic base rate ibr to 3 88 from 4 13. Bank lending rate in malaysia decreased to 3 70 percent in july from 3 89 percent in june of 2020. The new rates came into effect on 13 may 2019. Bank negara malaysia today issued the following faqs and guidances to provide further clarification on the requirements in the revised anti money laundering countering financing of terrorism and targeted financial sanctions aml cft and tfs policy document that was issued on 31 december 2019 and came into force on 1 january 2020.

The public bank base rate blr historical data stated above are for reference only. As at 6 august 2020. Rhb s base rate and base lending rate will be decreased by 20 basis points. Bank lending rate in malaysia averaged 6 30 percent from 1996 until 2020 reaching an all time high of 13 53 percent in may of 1998 and a record low of 3 70 percent in july of 2020.

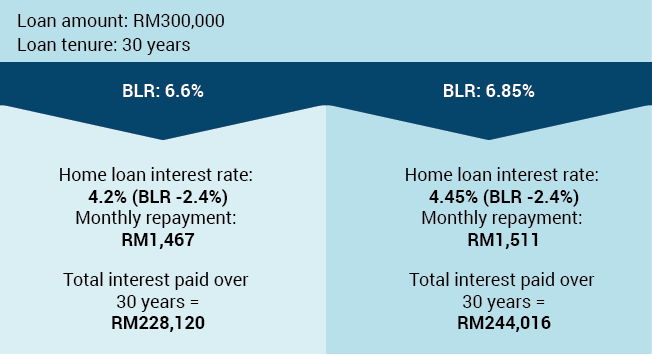

Please contact the nearest maybank branch for the latest rates. Indicative effective lending rate refers to the indicative annual effective lending rate for a standard 30 year housing loan home financing product with financing amount of rm350k and has no lock in period. All interest dividend rates quoted may change without prior notice.