How To Buy Bonds In Malaysia

Find out how individuals can buy sgs bonds.

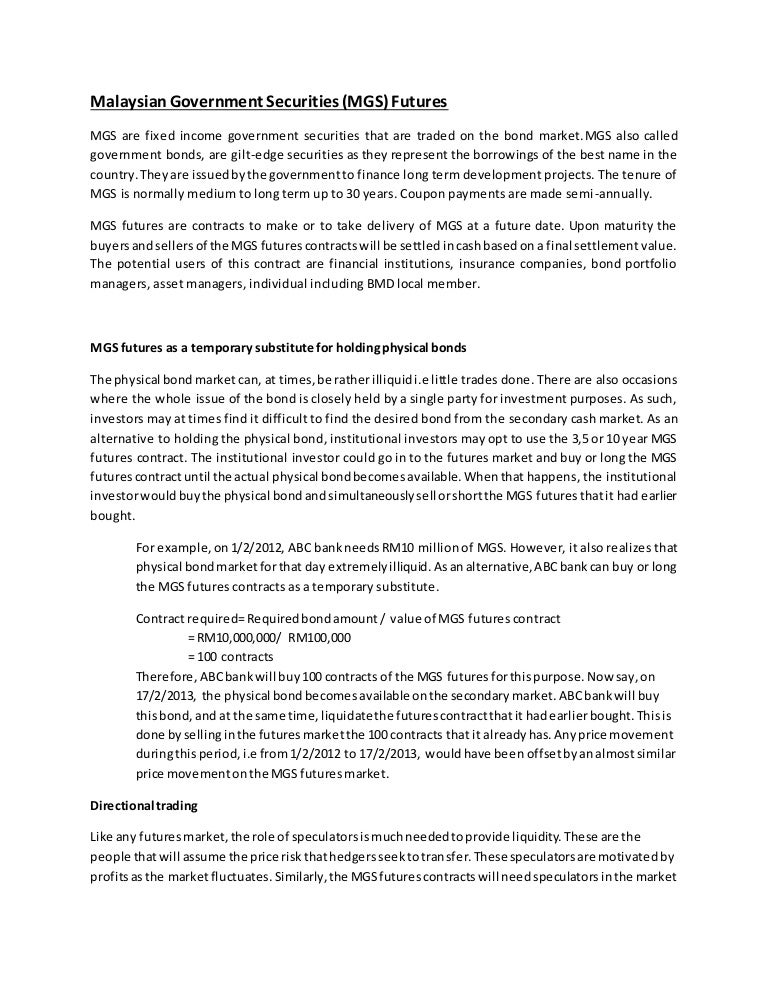

How to buy bonds in malaysia. Here are 6 things i consider when choosing a malaysian brokerage firm. Buying municipal bonds follows more traditionally with the standards in the bond market overall. Provides comprehensive malaysia s bonds market information and analysis yield curve for malaysian goverment bond malaysian government securities mgs islamic bond cagamas khazanah bond and corporate bond. The government of malaysia issues giis which are unsecured islamic bonds based on islamic principles bai al inah facilitated by bank negara malaysia.

It s important to pick a brokerage firm that suits your individual needs and preferences. When you buy a bond you are lending to the issuer which may be a government municipality or corporation. For investors who willing to take on more risk they can consider the wide variety of corporate bonds currently available on fsm bond. Investors can purchase sgs bonds at auction.

Auctions typically take place 3 business days before issuance and are announced on the sgs website 5 business days in advance. In 2019 ifast becomes malaysia s first retail bond eligible distributor in transacting bond and sukuk with retail investors. 3 to 10 years. Minimum amount of tender.

Extensive research analyses on funds and global markets and portfolios. And fund analysis tools on the website and mobile applications. Thus most investors buy municipal bonds through brokerage accounts. If you re malaysian and new to investing you re probably wondering how to buy shares in malaysia and open a malaysian brokerage account.

Bonds are issued on a discount basis. If you wish to sell bonds purchased through the bank the bank may repurchase it on best effort basis based on the prevailing market price under normal market circumstances but the buying price may differ from the original selling price due to changes in market conditions. You can apply through dbs posb ocbc and uob atms or internet banking. For risk averse investors malaysia government securities are good alternatives since these bonds are issued by the malaysia government and are widely considered to be free from credit risk.

There is an inherent risk that losses may be incurred rather than profit made as a result of buying and selling bonds.