How To Calculate Kwsp Contribution

How to calculate epf contribution.

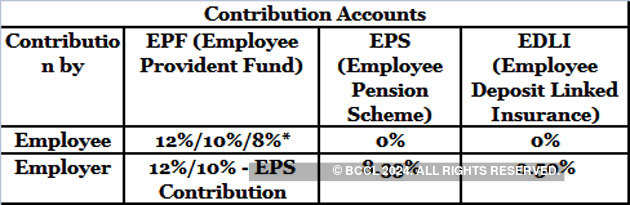

How to calculate kwsp contribution. This calculator helps you to estimate your total savings in epf when you retire. Interest on the employees provident fund is calculated on the contributions made by the employee as well as the employer contributions made by the employee and the employer equals 12 or 10 includes eps and edli of his her basic pay plus dearness allowance da. When wages exceed rm30 but. Late payment charge check eligibility check.

The calculator is updated with rates effective from january 2016. Epf contribution consists of two parts depending on the entity that makes the contribution employee s contribution and employer s contribution. In the event that the employer fails to pay the contributions within the prescribed period this contribution will be considered as an outstanding contribution. The epf officer will provide form kwsp 7 form e and form kwsp 8 form f.

Click to calculate the annual additional wage aw ceiling the aw ceiling sets the maximum amount of aw on which cpf is payable for the year. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13. Check eligibility check your eligibility. To simply the math assume that your basic salary is rs 25 000 including dearness allowance.

First category employment injury scheme. Your employee s contribution to epf and your employer s contribution. Calculators try out our calculators for all your needs. The interest rate earned on the epf balances as declared by the government each year.

What it shows after entering the above information and submitting it the calculator will show how much you will save by the time you will retire. The employee makes a contribution of 12 of basic salary dearness allowance towards his epf account. Under certain circumstances the epf will make an assessment of the contribution. Your epf contribution your contribution towards epf is 12 of rs 25 000 which amounts to rs 3 000 each month.

Wages up to rm30. Click to calculate cpf contributions for 1 st and 2 nd year singapore permanent residents. Check eligibility check your eligibility. This amount is calculated each month.

Kwsp epf contribution rates. The employee has to make a lower 10. A 10 rate is applicable in the case of establishments with less than 20 employees sick units or units that meet certain. The epf functions through monthly contributions from employees and their employers towards saving accounts.

The epf employees provident fund is a malaysian government agency that manages a compulsory savings plan and retirement planning for private and non pensionable public sector employees.