How To Do E Filing Malaysia

E be if you don t have business income and choose the assessment year tahun taksiran 2015.

How to do e filing malaysia. Go to e filing website. Select applicable form type and year of assessment. Filing your tax through e filing also gives you more time to file your taxes as opposed to the traditional method of filing where the deadline is usually on april 30. Sepanjang sesi penyenggaraan ini semua aplikasi e filing m filing taef e bas e kemaskini e spc dan e lejar tidak dapat dicapai.

It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic. E filing malaysia court to read the full article with step by step diagrams in pdf. Especially with the income tax e filing system introduced this year with a new face lift how do we go about it. Advertisement if this is your first time filing your tax through e filing don t worry we ve got your back with this handy guide on e filing.

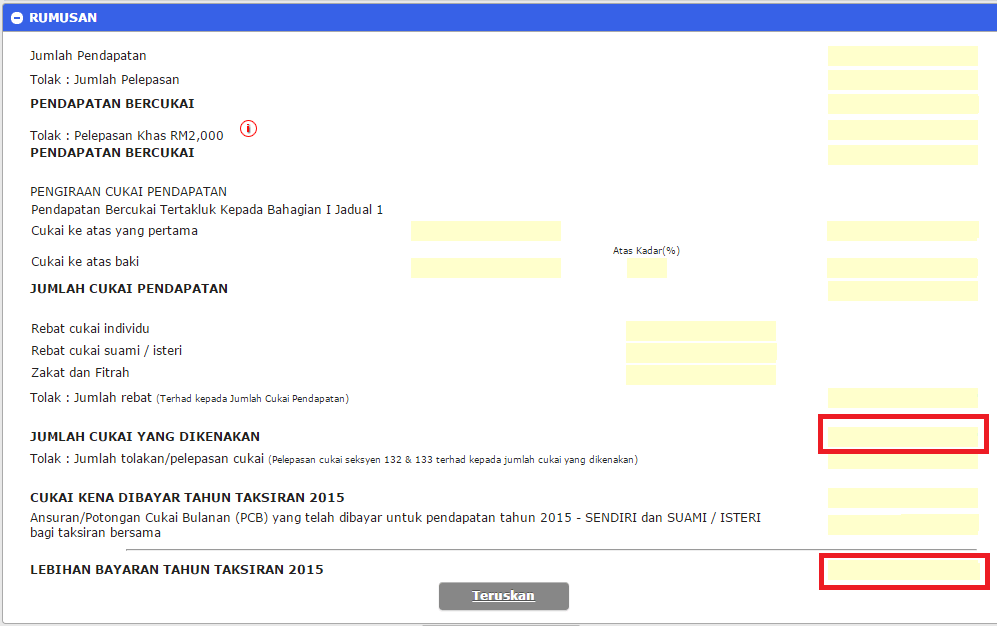

Ezhasil e filing is a most convenient way to submit income tax return form itrf. Click on e form link under e filing menu. However please be mindful to always check with your lawyers and seek professional advice on your queries regarding any legal proceedings. Ezhasil system will display screen as below.

How to use lhdn e filing platform to file e form borang e to lhdn all employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967. User manual e form ezhasil version 3 3 user manual e form ezhasil version 3 3 8 1 4 e form services screen will be displayed when users successfully login ezhasil as below. When you arrive at irb s official website look for ezhasil and click on it at the various options available on the ezhasil page choose the mytax option. Pemberhentian pengeluaran sijil taraf orang kena cukai stokc mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc.

Please click on this link. Normally taxpayers can start to e file their itrf for previous tax assessment from 1st of march. Choose your corresponding income tax form i e. On and before 30 4 2020.

How to do e filing for income tax return in malaysia the easiest quickest and most hassle free way to submit income tax return form itrf is via e filing. Once you ve logged in under the e filing section click on e borang and that will take you to your tax e filing form.