Life Insurance Dan Epf Including Not Through Salary Deduction

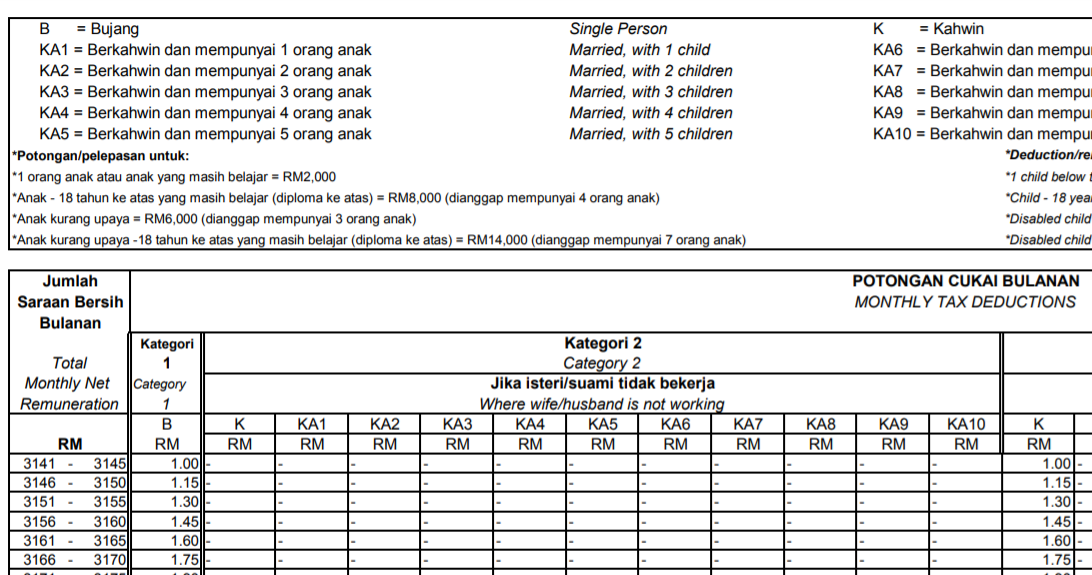

Life insurance and epf including not through salary deduction pensionable public servant category life insurance premium.

Life insurance dan epf including not through salary deduction. Insurance premium for education or medical benefit including not through salary deduction. Some made the silly mistake thinking this is applicable to insurance premium only. Other than pensionable public servant category life insurance premium restricted to rm3 000 contribution to epf approved scheme restricted to rm4 000 7 000 restricted 19. Insurance premium for education or medical benefit including not through salary deduction.

Life insurance and epf including not through salary deduction. Btw payroll my pcb calculator 2020 is powered by hr my s payroll calculator. Previously life insurance was combined as a single tax relief with epf contribution and capped at. F16 life insurance and provident fund limited to rm6 000.

Insurance premium for education or medical benefit including not through salary deduction. Payment of life insurance premiums in the year of assessment. Insurance premium for education or medical benefit including not through salary deduction 3. Voluntary contribution is included as well for tax relief purposes.

Up to rm3 000 for life insurance and up to rm4 000 for epf. Other than pensionable public servant category life insurance premium restricted to rm3 000 contribution to epf approved scheme restricted to rm4 000 7 000 restricted. Epf contribution through non salary deduction i e. Tax 2019 has split the epf and life insurance into 2 separate category life insurance premium.

Add that up with the epf contributions you made throughout the year the total amount is claimable up till rm6 000. Pensionable public servant category life insurance premium ii. Forever for unlimited employees. If your medical insurance is a standalone policy you can claim up to 100 of your total premium paid under the medical benefit category.

Life insurance and epf including not through salary deduction up to rm7 000 limited working adults who are making epf contributions should pay attention to this tax relief item as you can claim up to a whopping rm4 000 for epf and rm3 000 for life insurance or takaful. This part consists of both monthly epf contribution and life insurance premium paid. Other than life insurance the premium you are paying for medical and education can also be claimed. You should not ignore this part due to the huge sum of tax relief allowed.

Life insurance and epf including not through salary deduction i.