Malaysian Working Overseas Income Tax

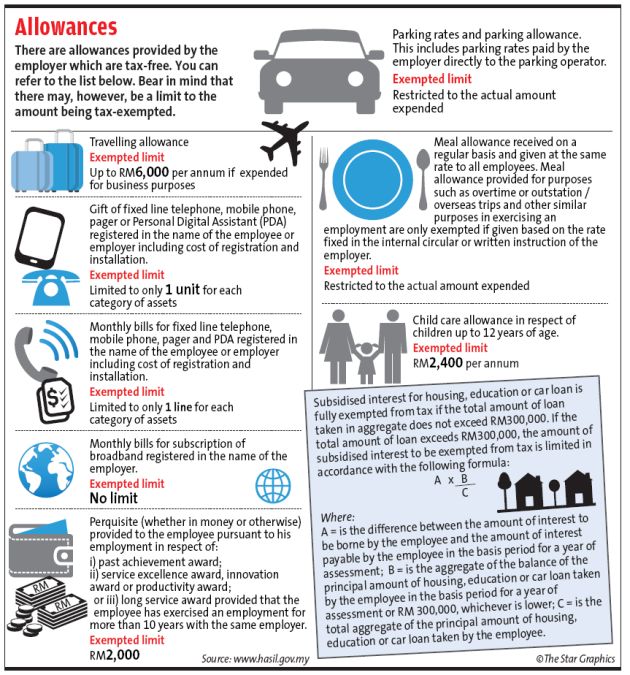

Your employer will send your employment income details including all allowances paid to you while you are.

Malaysian working overseas income tax. When filing income tax please fill in form b1 income tax return for residents. I pay tax to singapore i wonder if i need to submit my annual income report in malaysia note. I am 27 years old female. Malaysia taxes both residents and nonresidents only on income derived from a malaysian source or.

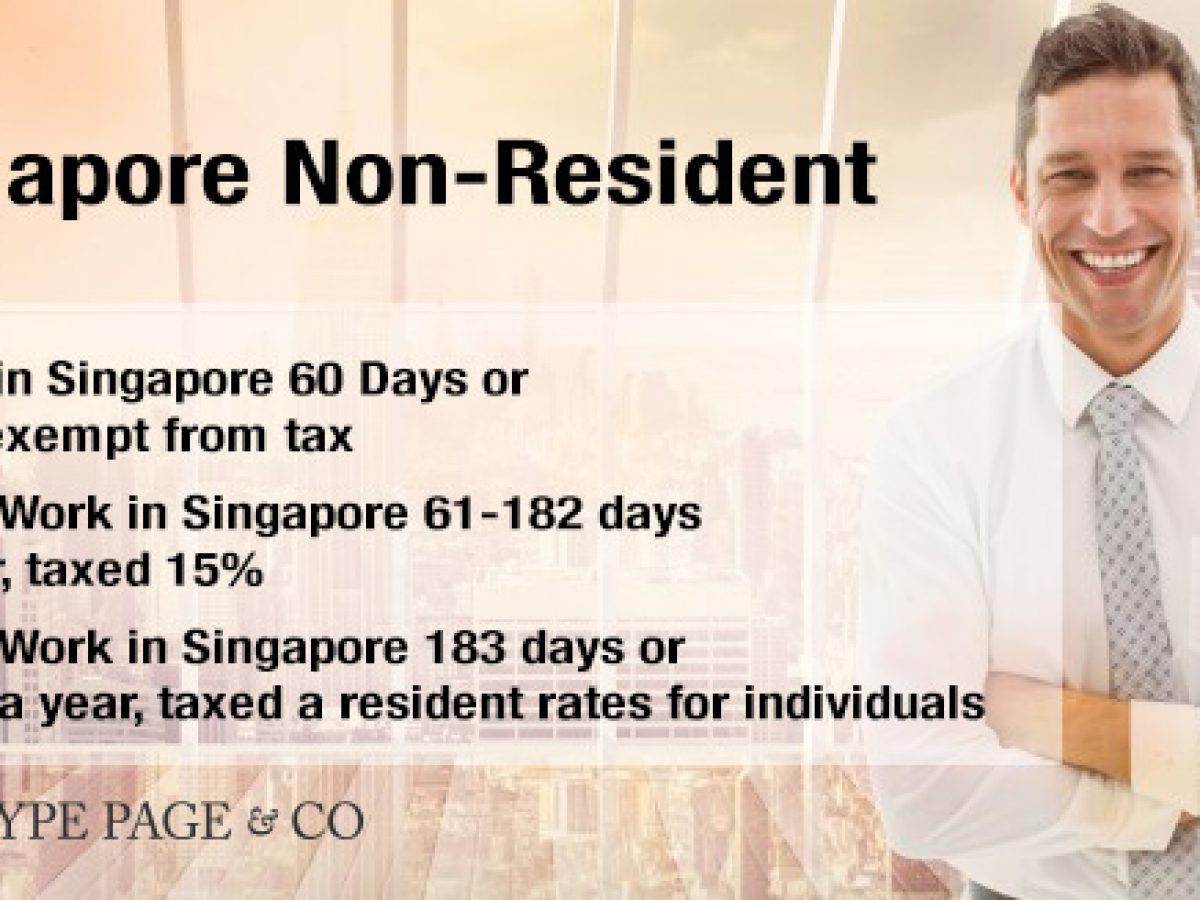

However he added if it was later discovered that any of their income was indeed subject to malaysian tax the irb had the power to raise the assessment against those individuals within five years or at any time if fraud wilful default or negligence was. If you do not receive the income in malaysia and it is not derived from a source in malaysia you are not subject to taxes on the income in malaysia. Any foreigners who have been working in malaysia for more than 182 days are eligible to be taxed under normal malaysian income tax laws and rates just like malaysian nationals. Even if they had brought their income which is derived from overseas into malaysia this will be exempt from income tax he explained.

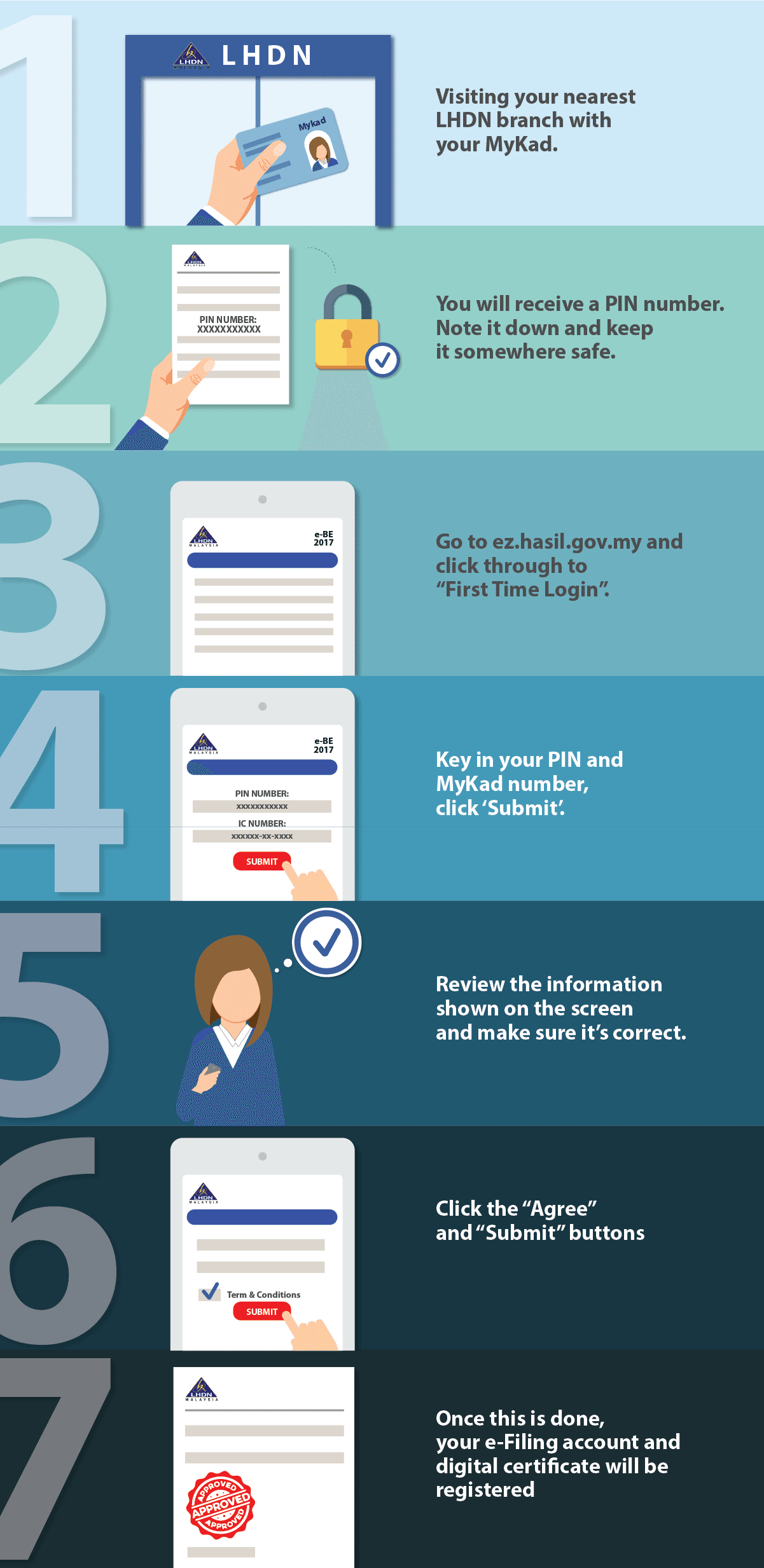

According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia. I have checked with jabatan hasil dalam negari jhdn that i haven t yet registered even though i have been working in malaysia for few months for each 2 company. All your gains from such employment including overseas allowances are taxable in singapore. Malaysians with foreign bank accounts what are the tax implications in malaysia.

For an individual residing in malaysia for a period exceeding 183 days the individual is deemed to be a resident for tax purposes in malaysia under the income tax act 1967 ita 1967 however if the said individual does not receive any income deriving from malaysia and only receives employment income derived from singapore then the individual is still not liable for tax in malaysia. Typically companies obtain income tax numbers for their foreign workers. Malaysia is having a tax amnesty period with the special voluntary disclosure program svdp starting from 3 november 2018 to 30 june 2019 to encourage people with income that are not reported for malaysian tax or any mistakes in the past years of assessment to disclose them to the inland revenue board of. To file income tax an expatriate needs to obtain an income tax number from the inland revenue board of malaysia irb.

I resident in malaysia. With effect from ya 2004 foreign source income derived from sources outside malaysia and received in malaysia by any person other than a resident company carrying on the business of banking insurance or sea or air transport is not subject to malaysian income tax. As a singapore citizen or tax resident in singapore the income from your employment exercised outside singapore on behalf of singapore government is deemed to have been derived from singapore.