Personal Relief Malaysia 2017

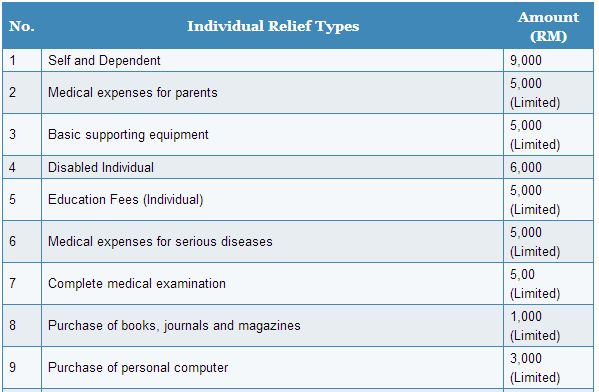

No guide to income tax will be complete without a list of tax reliefs.

Personal relief malaysia 2017. The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too. For expatriates working for labuan international there is a special rebate where foreign directors income is zero tax and expatriate employees are subject to a 50 rebate in their earnings. There is an increase in tax payable of 797 44 900 102 56 for mrs chua from ya 2017 to ya 2018 due to the relief cap. 5 000 limited 3.

We ve listed seven of the things you can spend more to save on your 2017 income tax but of course there are plenty more things listed on the 2017 income tax relief which you can view here. Technical or management service fees are only liable to tax if the services are rendered in malaysia while the 28 tax rate for non residents is a 3 increase from the previous year s 25. Pwc 2016 2017 malaysian tax booklet personal income tax tax residence status of individuals an individual is regarded as tax resident if he meets any of the following conditions i e. Refer to this list of the income tax relief 2018 malaysia.

Medical expenses for parents. Malaysia s prime minister presented the 2017 budget proposals on 21 october 2016 offering up some new relief measures in the form of new lifestyle tax deductions to taxpayers. Instead he announced a few tax reliefs including the new lifestyle tax relief. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.

Some items in bold for the above table deserve special mention. The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills. This relief is applicable for year assessment 2013 and 2015 only. Malaysia personal income tax guide 2017 home blog income tax malaysia personal.

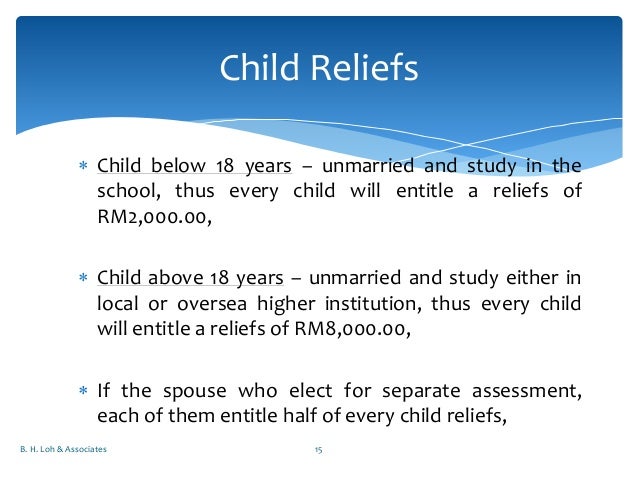

Let s take into account the standard rm 9 000 individual tax relief and a maximum relief of rm 6 000 for epf contributions. Amount rm 1. The tax relief is aimed to ease the burden of parents with children of up to 6 years old and can be claimed by either parent of the children starting from. As the total amount of personal reliefs claimed by mrs chua exceeds the overall relief cap of 80 000 the total personal reliefs allowed to her is capped at 80 000 for ya 2018.

2018 personal tax incentives relief for expatriate in malaysia. However in his budget 2017 speech prime minister datuk seri najib razak did not announce any change to personal income tax rates.