Renovation Capital Allowance Malaysia

Inland revenue board of malaysia accelerate capital allowance public ruling no.

Renovation capital allowance malaysia. In malaysia for a period of less than 182 days during the year shorter period but. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. 8 oktober 2018 inland revenue board of malaysia page 2 of 19 4 3 the conditions that must be fulfilled by a person to qualify for an initial allowance ia and an annual allowance aa are the same as the conditions to claim capital allowances at the normal rate under schedule. This change seeks to eliminate double incentivisation where the capital grants are not taxed while the expenditures funded by these grants are eligible for capital allowances.

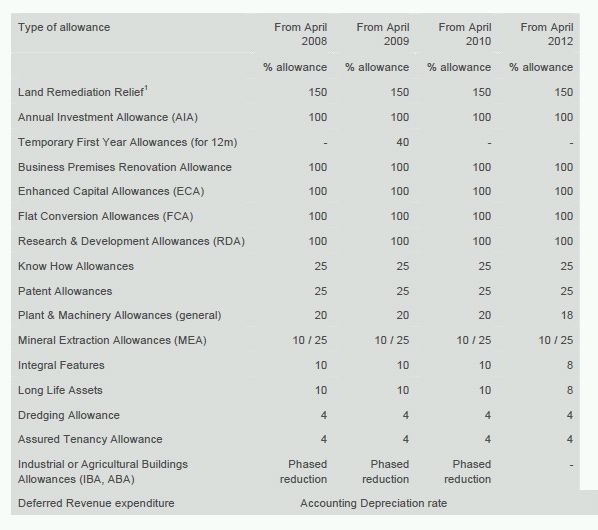

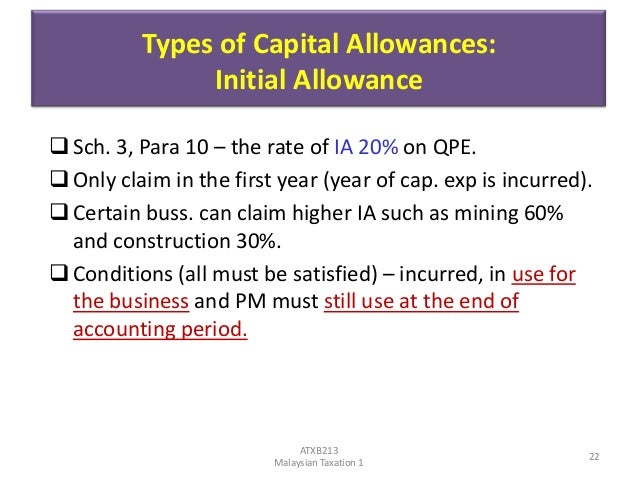

Capital allowances tax incentives income exempt from tax double tax treaties and withholding tax rates real property gains tax stamp duty sales tax service tax. Capital allowances consist of an initial allowance and annual allowance. Related provisions 1 3. While annual allowance is a flat rate given every year based on the original cost of the asset.

15 april 2013 contents page 1. C notional allowance which is equal to the annual allowances if claimed or could have been claimed. Qualifying expenditure 3 6. Generally r r expenditure does not qualify for capital allowances as the expenses incurred are in relation to the business setting and not for plant or machinery.

7 2018 date of publication. Capital allowance 3 5. 6 2015 date of publication. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred.

As announced in budget 2020 capital allowances will no longer be given on expenditures funded by capital grants from the government or statutory boards that are approved on or after 1 jan 2021. Under the second stimulus package the minister has made the rule income tax renovation or refurbishment expenditure rules 2010 p u a 20 2010 wherein are specified expenses incurred on the renovation and refurbishment of business premises between 10 march 2009 and 31 december 2010 be given accelerated capital allowances aca at the rate of 50 and qualifying expenditure for aca. The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. Inland revenue board of malaysia computation of capital allowances public ruling no.

4 2013 date of issue. The total capital allowances of such assets are capped at rm20 000 except for smes as defined. Standard rates of allowances under schedule. 3 5 company means a body corporate and includes any body of persons established with a separate legal entity by or under the laws of territory outside malaysia and a business trust.