Rhb Bank Housing Loan

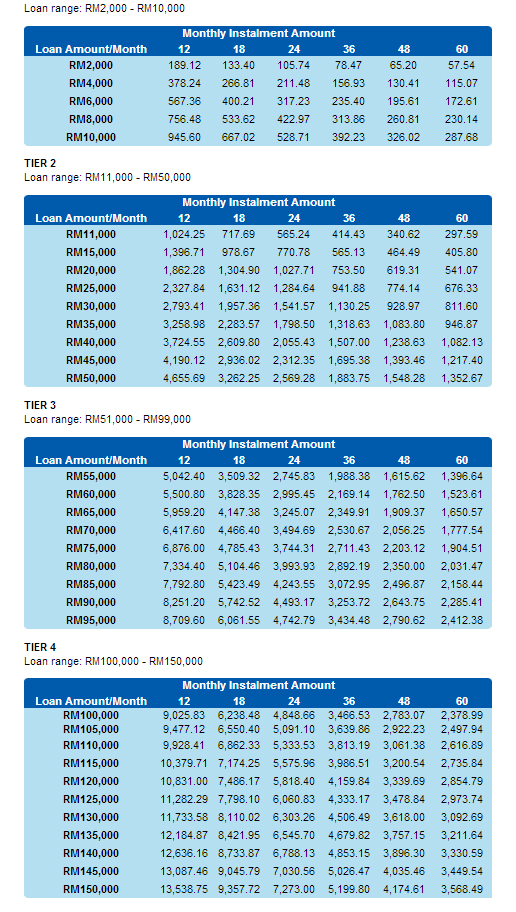

For rhb furnishing loan.

Rhb bank housing loan. Rhb bank berhad is the fourth largest fully integrated financial services group in malaysia. Established in 1997 from the merger of two banks to create malaysia s third largest financial services group. Our rhb housing loan with flexible options is the key to quickly own your dream house. 35 years or age 70 whichever is earlier redraw fees.

The total loan amount for your rhb renovation loan will be capped up to 6 times your monthly income as indicated in the income documents subject to a maximum of sgd 30 000 or amount rhb bank may in its absolute discretion determine. Safe transition update on branches updated as at 24 august 2020 dear customers please take note that our geylang and jalan besar branches will reopen on 27 august 2020 while our katong branch remains closed until further notice. We are committed to serving your banking needs and at the same time safeguarding your wellbeing during this period. Loan period up to 20 years.

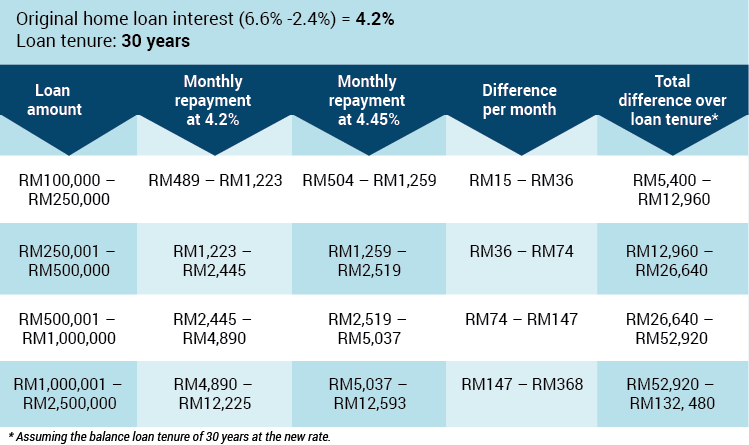

Minimum 5 years maximum. The highlight of this rhb bank home loan products is you can enjoy special rhb housing loan rate for properties above rm400 000. 4 30 br 3 0 ocbc standard housing loan. Rhb mortgage loan packages come with maximum loan tenure of up to 35 years or until the borrower reaches the age of 70.

18 years old loan tenure. 4 4 br 3 65 hong leong housing loan. 4 35 br 3 72 rhb my1 home loan. Rhb bank berhad now has 210 branches in malaysia with 196 rhb conventional bank branches and 14 rhb islamic branches.

Upon request you can also get special low rhb housing loan rate. 4 45 br 3 65 affin home invest i. Financing up to 70 of the property value. 4 35 br 3 5 maybank maxi home.

Some of the supporting documents that you will need to provide to the bank when are applying for rhb islamic home loan are. Application form nric identity card copy of sales and purchase or booking receipt or letter of offer from developer copy of individual title deed property valuation report for completed properties latest 3 consecutive months of salary slips vouchers. Rm30 000 inclusive of mrta. 4 65 br 3 9 citibank flexihome loan.

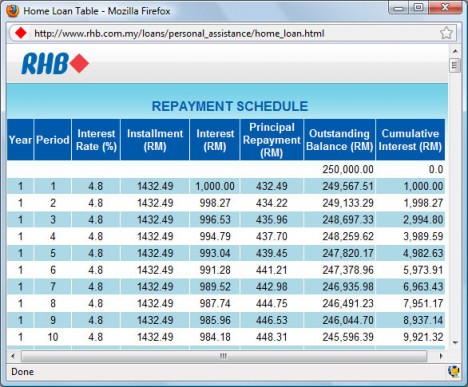

Instead of looking at interest rate first like most people do it will be wise to shift your attention to rate type instead. 4 4 br 3 69 hsbc ideal home plan. A home loan is very different from the typical unsecured loans you see such as personal or renovation loan where the calculation is based on flat add on method. Do a quick calculation on your monthly repayments using our online housing loan calculator and save more.

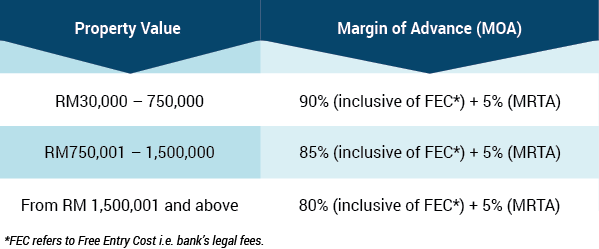

Get interest rates from as low as 4 15 on your housing loan. Bank name home loan interest rate. Finance entry cost fec which includes legal fees and valuation fees.