Service Tax Credit Card

B new card approved from 1 september 2018 on the card activation date of each card.

Service tax credit card. Effective 1 september 2018 rm25 service tax will be imposed on each principal and supplementary credit card as per the following. Credit card holders will be charged with an annual rm25 service tax which is expected to contribute an additional rm225 million to the national revenue. The rate of service tax to be imposed is rm25 per card per year or part thereof. Service tax on credit cards frequently asked questions faq 1.

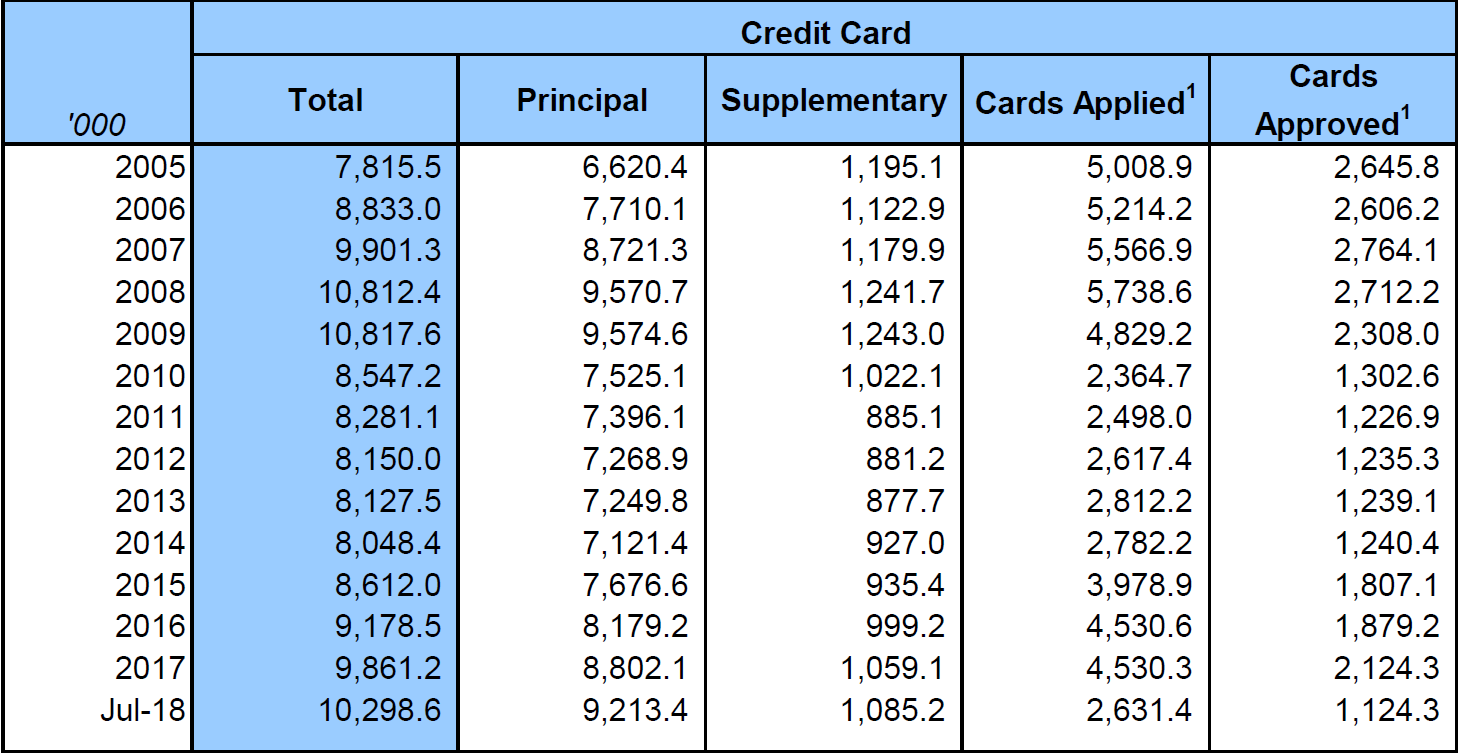

Under the service tax rate of tax order 2018 lim said rm25 will be charged for each principal credit card or charge card on the date it is activated or the date it is renewed and every time the card is renewed. According to the order the same rm25 service tax will be charged under the same situations for supplementary credit cards or supplementary charge cards. Service tax is governed by the service tax act 2018. However this could lead to a drop in the number of credit and charge cards being used just as it did the last time such a tax was introduced.

It is a federal consumption tax imposed on customers for certain taxable services purchased or utilised. If the card is not activated within 3 months the service tax will be imposed on the 3rd month. Further details may be obtained from royal malaysian customs. 6 when will the service tax be imposed.

I new card for new card service tax will be imposed upon activation of the card. The rate of service tax to be charged is rm 25 per card per year or part thereof for the activated or renewal of a principal or supplementary credit card or charge card. Rm50 00 for pb world mastercard credit card 14. Types of charges amount rate remarks.

What is service tax. Under the old service tax model a service tax of rm50 a year on each principal credit card and charge card and a service tax of rm25 a year on each supplementary card was implemented. Credit card service tax. Rm25 00 will be imposed on each principal and supplementary credit card and charge card upon new card activation date including activation of temporary cvv and subsequently upon the anniversary of your card approval date.

The table below shows how the service tax will. Rm25 per annum on the principal card. A existing card approved before 1 september 2018 on the yearly renewal date of each card. And rm25 per annum on each supplementary card.

For existing credit cardholders service tax of rm25 will be charged on the anniversary month of each of your primary and or supplementary credit cards.