Travelling Allowance Exemption Malaysia

If the amount exceeds rm6 000 further deductions can be made in respect of amount spent for official duties.

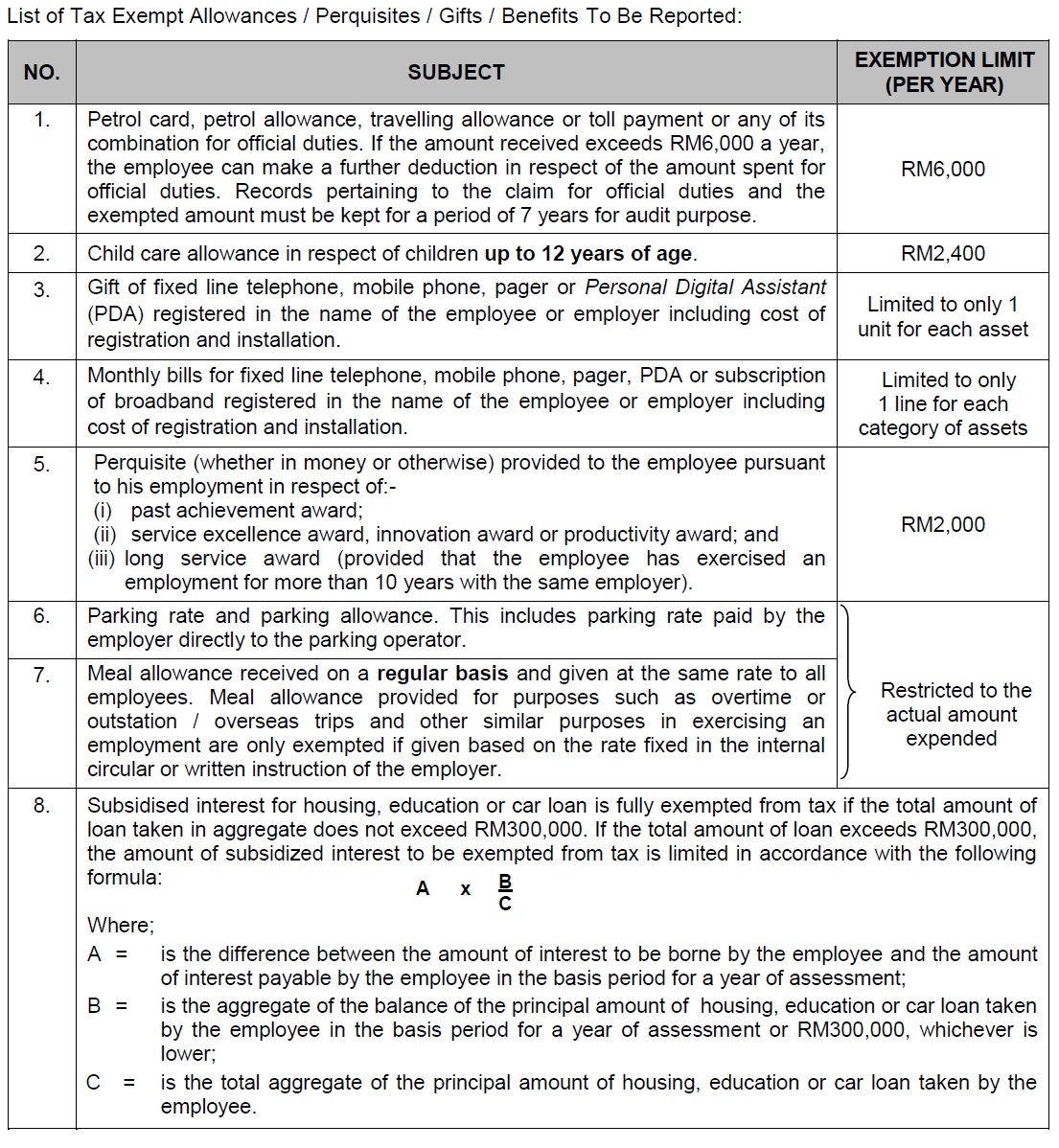

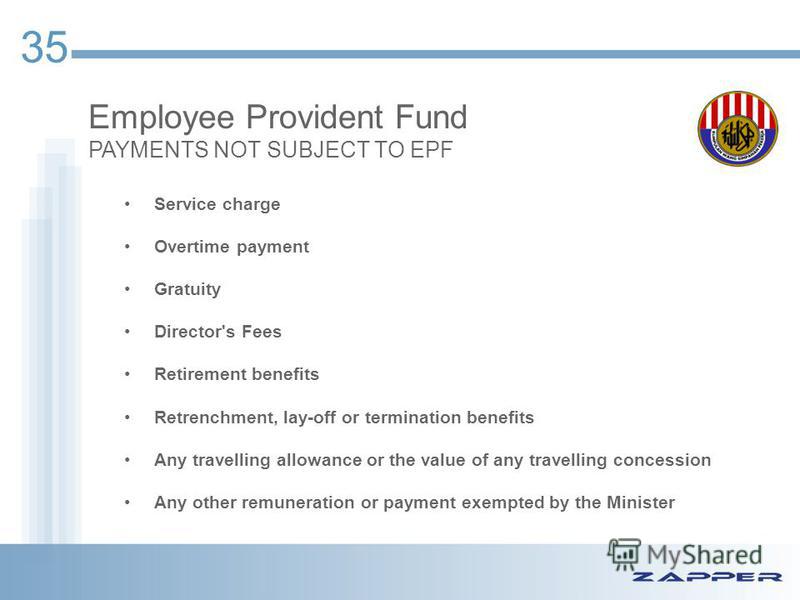

Travelling allowance exemption malaysia. Meal allowance received on a regular basis. Includes payment by the employer directly to the parking operator. In malaysia employees are allowed to claim tax exemptions for the benefits perquisites below unless the employee has shareholding or voting power in the company. The exemption is effective from year of assessment 2008 to year of assessment 2010.

Individual chairman member of upsc. Tax exempt as long the amount is not unreasonable. Within 5 years after the end of the year the exemption relief remission allowance or deduction is approved. For tourists and travellers to malaysia here is our quick guide to the duty tax free exemptions and allowances travellers tourists and visitors may bring in goods and used personal items into malaysia duty free for personal use only.

Approval for exemption relief remission allowance or deduction is granted after the ya in which the return is furnished. Real property gains tax rpgt exemption for malaysians for disposal of up to three properties from june 1 2020 to december 31 2021. Travelling allowance or petrol allowance received by an employee for travelling from home to place of work and from place of work to home is exempted up to an amount of rm2 400 per year. The exemption in respect of long service award shall only be given to employees who have served the same employer for more than 10 years.

Includes payment by the employer directly to the childcare provider. Full exemption of tourism tax from july 1 2020 until june 30 2021. Exempt subject to maximum of rs. 14 000 per month for defraying the services of an orderly and for meeting expenses incurred towards secretarial assistant on contract basis.

Petrol allowance petrol card travelling allowance or toll payment or any combination. 10 45 allowances to retired chairman members of upsc. D leave travel concession. Income tax exemptions of up to rm1 000 for local travel expenses will also be extended until the end of 2020.

Petrol card petrol allowance travelling allowance or toll payment or any of its combination for official duties. Allowance or fees for parking. Tax exempt up to rm2 400 per year. Here are the 14 tax exempt allowances gifts benefits perquisites.

Petrol allowance petrol card travelling allowance or toll payment or any combination. Parking rate or parking allowance. Tax exemption limit per year petrol travel toll allowances. If the amount received exceeds rm6 000 a year the employee can make a further deduction in respect of the amount spent for official duties.

Allowances 3 2 1 travelling allowance petrol allowance or toll rate i. The exemption relief remission allowance or deduction is published in the gazette. Travelling allowance petrol card petrol allowance or toll payment for travelling in exercising an employment is exempted up to an amount of myr6 000 per year. Records pertaining to the claim for official duties and the.